Faqs

In some respects this is quite simple: a positive result in this referendum brings the federal government and other provinces to the table to negotiate a fairer deal for Albertans (and all Canadians) on Equalization and other fiscal arrangements.

That said, Equalization is a complex program with a complex formula, and provincial referenda on constitutional matters are quite rare, so we’re happy to provide answers to the most common questions. This page will be updated as other questions emerge.

The Alberta government pledged to use a referendum on Equalization to trigger negotiations with Ottawa to reform Equalization and other federal transfers.

Holding the referendum on the province-wide municipal election day this October reduces costs and improves turnout.

Alberta cannot unilaterally change federal programs like Equalization or remove reference to it in the Constitution. Changing the program will require federal government changes, likely informed by consultations with all provinces. Amending the Constitution would require 7/10 provinces representing 50% of the population.

Fortunately, Constitutional change isn’t required; the goal is to get reforms that make federalism more fair for Albertans. Announcing this referendum process has already spurred some of the national conversation required to start building a consensus to reform the program – as you can see by clicking on our ‘Reading Room’ tab above. In particular, Fairness Alberta’s columns in the National Post and more recently in the Financial Post show that BC, Ontario, and Saskatchewan can benefit a great deal from Equalization reform. This highlights that Alberta is not alone: a majority of Canadians should be demanding an overhaul of this flawed program.

Regarding the legitimacy of the vote itself, the Supreme Court repeatedly declared in their 1998 Secession of Quebec reference (details below) that provinces have a right to constitutional referenda and a clear majority on a clear question in any province would create a duty for the federal government and other provinces to enter into discussions to address it.

Dr. Bewick made this case in an August National Post column, and you can see details of the Supreme Court’s reference for yourself here:

Background

Alberta alone cannot change the Constitution, but a strong result would trigger a duty for the federal government and other provinces to come to the table. This duty is a common sense one in that a province must really be upset about an issue if they successfully go to that length, and provinces should all at least be equal in dignity; this duty has also been affirmed by the Supreme Court.

The logic for this approach flows from the Supreme Court’s 1998 Secession of Quebec reference where they confirmed that while a provincial referendum would not on its own alter the Constitution, provinces can initiate constitutional change: “a clear majority vote…on a clear question…would confer democratic legitimacy…which all of the other participants in Confederation would have to recognize.”

While that quote is in the context of secession, the broader principle is repeatedly reinforced in the Court’s writing. 1998 SC ref sec(2) and s(150): “Our democratic institutions necessarily accommodate a continuous process of discussion and evolution, which is reflected in the constitutional right of each participant in the federation to initiate constitutional change. This right implies a reciprocal duty on the other participants to engage in discussions to address any legitimate initiative to change the constitutional order.”

In sec. 69 the Court adds: “The Constitution Act, 1982 gives expression to this principle, by conferring a right to initiate constitutional change on each participant in Confederation. In our view, the existence of this right imposes a corresponding duty on the participants in Confederation to engage in constitutional discussions in order to acknowledge and address democratic expressions of a desire for change in other provinces.”

Yes. They have helped immensely, and even if Equalization was eliminated tomorrow Ottawa would still be using the federal spending power to shift large sums to the so-called ‘have-nots’ from taxpayers in provinces like Alberta, B.C., and Ontario.

Albertans sent $630 billion since 1960. Or to make that more current, $324 billion of Albertans’ federal taxes went to other provinces from 2000-2019. That works out to about $324,000 per family of four over two decades. Equalization was only around 12-15% of that total.

As we explain below, the ‘poorer’ provinces have largely caught up to Alberta and the other provinces since the energy price collapse in 2015. What’s more, the Equalization formula does nothing to measure service delivery results, nor the relative cost of living; it merely assumes that poorer provinces deserve the same revenue capacity for services as productive and growing provinces like Alberta and Ontario do.

It also assumes $21 billion in federal tax dollars should go solely to 5 provinces towards making that happen, regardless of how close the provinces are or what the provincial pressures in provinces like Ontario, B.C., and Alberta are.

This federal program is supposed to be aimed at ensuring each province can “provide reasonably comparable levels of public services at reasonably comparable levels of taxation” as per sec. 36(2) of the Constitution. It began in 1957 when the Federal government started significant funding of provincial responsibilities.

Funding comes from all federal taxes and revenues. The $21 billion tab for the entire Equalization program this year means Ontarians are paying about an $8.5 billion share through their taxes; in Alberta and B.C. the total contribution to it is closer to $3 billion each.

This works out to an annual share of $2300 per BC family of four; $2400 for Ontario families, and $2700 for Alberta families – to fund a program that sends $21 billion in cheques straight to 5 other provincial governments.

Quebec’s provincial government will get $13 billion. That is the equivalent of $6,000 per Quebec family of four going straight to their government to subsidize their (often expanded) provincial services. The remaining $8 billion is divided by the governments of Manitoba, New Brunswick, Nova Scotia, and P.E.I., each of whom gets an even larger per capita amount than Quebec.

We published a column last summer explaining 8 flaws with Equalization.

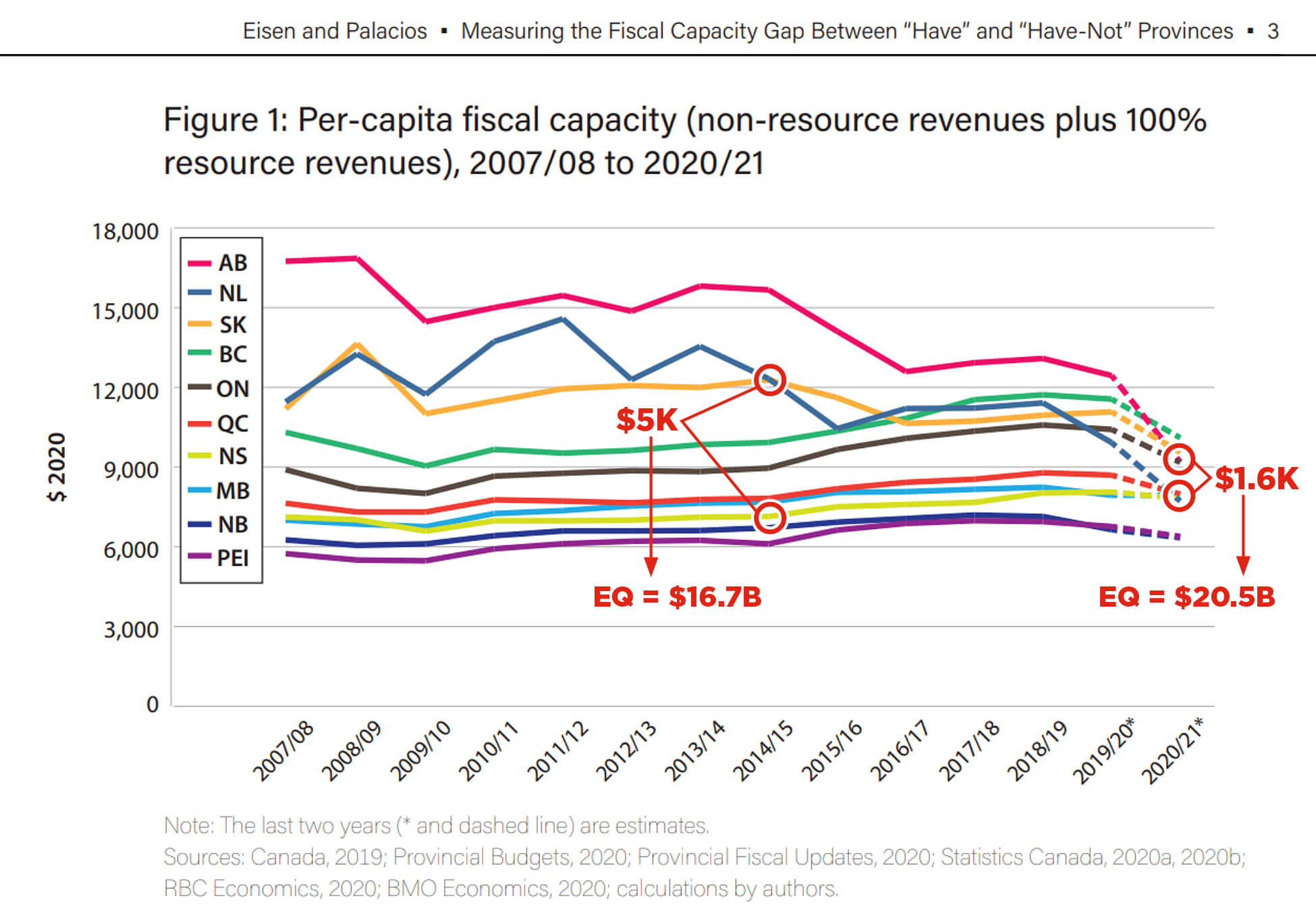

GDP Growth Rule: More recently in the National Post we zeroed in on the most obvious flaw: the overall Equalization budget keeps growing with GDP, meaning payments to 5 provinces keep rising despite all provinces converging in wealth over the last 5 years. As this graphic from a Fraser Institute report (combined with the red emphasis added) makes very clear, Equalization is bigger than ever but less necessary than ever.

By taking so many federal tax dollars from provinces facing steep declines like Alberta and Newfoundland and handing them to other provincial capitals, this program is effectively making it harder for those “have” provinces to deliver comparable services.

Hydro: Another flaw is the way Hydro revenues are factored in, especially in Quebec. Because the province chooses to subsidize rates it makes their enormous utility seem relatively unprofitable. Properly counting the capacity for profit in Quebec Hydro would lower their payment by about $5.5-$7 billion as outlined in the Globe and Mail and Finances of the Nation (assuming a hypothetical 3-4 cent rate increase for calculation purposes) https://www.theglobeandmail.com/business/article-it-could-be-politically-perilous-to-tweak-the-equalization-formula-to/

Cost of Services: the goal of Equalization, you’ll recall, is to ensure poorer provinces can afford reasonably similar services. To estimate this ability, Equalization only looks at a province’s ability to fund services while ignoring the differences in the cost to deliver services. Staff costs are the biggest line item; the cost of living is lower in recipient provinces, and so are their salaries – so why would that province need the same revenue capacity as Ontario or Alberta where salaries are higher?

Dr. Trevor Tombe helped a group called “Finances of the Nation” develop a calculator where variables like hydro rates, the GDP growth rule, and a CPI index can be changed and payments automatically adjusted: https://financesofthenation.ca/equalization/

Once the growth rule above is turned off, factoring in CPI differences alone transforms the payments: now down to $13 billion overall, Quebec drops over $7 billion, (MB $1 billion, NB $0.5 billion) and Ontario suddenly gets $2.6 billion of its citizens’ contributions back in a payment.

Once you adjust Quebec’s Hydro by 4 cents of subsidy, their payment nearly disappears entirely and Ontario is suddenly up to $4 billion back from a program that is now half the overall size (over $10 billion savings).

That frees up $10 billion for tax reductions, debt reduction, or rebates to struggling provincial treasuries in Alberta, Ontario, BC, Saskatchewan, and Newfoundland– all are far fairer and more defensible uses of those tax dollars, and all these options would benefit not only Albertans but 70% of Canadians.

This is a common claim, but it’s not at all that simple.

Incomes do determine the proportion of federal revenues Albertans pay (14-17%). But the size of the federal budget determines the rates they need to set/dollar amount taxed (about $50 billion from Albertans); also, the relatively low amount spent back in Alberta (about $30 billion) is the other obvious but too-often forgotten element that decides the net contribution.

Size of budget: You’ve no doubt noticed your federal tax bill is more than double your provincial one, but that is not because federal responsibilities are more expensive. Over the decades the federal government has crept more and more into provincial affairs. Now, roughly 50% of our federal taxes go to items that constitutionally fall under provincial jurisdiction (e.g. health, social services, seniors, children, education). If they stepped back, cut out the middleman, and gave that tax room to provinces to raise the revenues for health and social services directly, there would be far less redistribution. Additionally, and perhaps more importantly, those tax dollars would be billed directly by the order of government accountable for spending them.

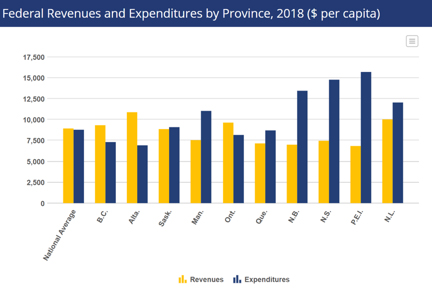

Amount spent back in Alberta: As this graphic from the Library of Parliament shows, the federal government spends less per capita in Alberta than any province (blue bars). The amount taxed from Albertans (yellow bars) was actually closer to the average than the amount spent back.

That means our net transfer was caused more by the lack of federal spending than it was by the taxes from higher incomes.

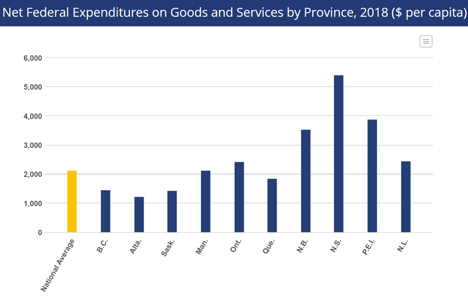

This lower spending is only partly explained by demographics (younger, employed people); “goods and services” spending is also by far the lowest in Alberta despite all our military bases and Indigenous communities (see below). The other prominent category – provincial transfers – is obviously lower because we get no Equalization and complementary programs like Fiscal Stabilization are unfairly small (read column).

Albertans paying 14% of the tab but getting $915 less per capita than average in federal spending on “goods and services” adds up to nearly $6 billion going into other provincial economies at Albertans’ expense.

While Quebec gets less per capita (see Library of Parliament charts above) they were the largest net recipient by far ($498B) in the 1960-2019 period where Albertans led with $630B contributed.

Quebec also gets 60% of the bloated Equalization pot in 2021 ($13B). As shown in Dr. Bewick’s Calgary Herald column, fixing 3 flaws in the program drops that payment down below $1B, illustrating that the major flaws unduly benefit Quebec.

Finally, when you factor in the lower cost of living, it is not clear just how needy Quebec’s government is. Certainly their higher tax rate is the largest factor in them balancing their budget in recent years, but it would not be possible without that $13B Equalization payment. Their generous daycare and tuition subsidies are proof that they can afford quality services.

Lastly, Quebec can afford to start a “Generations Fund” that is scheduled to surpass Alberta’s Heritage Savings Trust Fund in two years. Again, higher taxes is a key to that but so is the net $498B transferred to Quebec since 1960, which includes their large Equalization payments.

(One might suggest that Alberta’s fund might have grown much, much larger if that $324B had not been transferred out by Ottawa since 2000.)

Equalization is the easiest program to point to because it literally sends multi-billion grants only to select provinces. Albertans put about $3 billion into it annually – a sizeable sum but only 15% of the $17-20 billion annual net contribution from Albertans over the last few decades. Still, no single program is a larger source of redistribution.

As explained under the tab “Big Picture” at www.Fairnessalberta.ca, the Canada Health Transfer and Canada Social Transfer (CHT/CST) combined are almost as significant as Equalization in terms of shifting wealth to other provinces because Albertans have been paying so much more than the per capita share they get back. Federal spending on goods and services is another significant source of imbalance (above), as are seniors’ benefits like OAS and CPP given our demographics.

No. Alberta has had a steep decline, and has not recovered from the $8B drop in provincial revenues in 2015, but it is still above average and is expected to remain a contributor.

From 2015-19 — five years during which Alberta racked up $44 billion in new debt — the net fiscal transfers out of Alberta were still $90 billion. Dr. Ted Morton has used these numbers to argue that the problem is not that Albertans don’t pay enough taxes. The problem is that too many federal tax dollars don’t come back to Alberta.

No. As laid out above, when Albertans have relatively higher incomes, they pay a much higher share of every federal program; just as importantly, they will surely continue to get the least spending per capita even after Equalization reform.

Equalization comprises ‘only’ $3 billion out of the $20 billion Albertans sent annually in taxes that was spent by Ottawa in other provinces from 2007-2019. Even with a full refund on our Equalization tab, the predominance of the federal taxing power means the redistribution of massive sums to Quebec, Manitoba, and Atlantic Canada will continue through Ottawa’s myriad of other programs.

No. Efforts like this to force these issues onto the national agenda are the only way to prevent the growth of separatism. This referendum is a chance for Albertans to express their frustration by way of a means sanctioned by the Supreme Court of Canada (see above).

Smothering that frustration with national indifference is what provokes separatism. When you see the numbers in terms of Albertans’ net contributions to Ottawa ($324 billion from 2000-2019, or $324,000 per family of four), and in return how much Ottawa policies are chasing out the investment they need for future prosperity – it’s impossible not to understand the frustration. When something as vital as people’s kids’ and grandkids’ chances of a good job and a good life close to their resource-rich and beautiful home is at stake, nobody should underestimate where sustained unfair treatment could lead.

Equalization comprises ‘only’ $3 billion out of the $20 billion Albertans sent annually in taxes that was spent by Ottawa in other provinces from 2007-2019. Even with a full refund on our Equalization tab, the predominance of the federal taxing power means the redistribution of massive sums to Quebec, Manitoba, and Atlantic Canada will continue through Ottawa’s myriad of other programs.

Yes. Share the fact-based information on these topics with your friends and family – especially those outside the province – and encourage them at the same time to demand their politicians commit to reforms.

National unity is actually at stake, and the situation is clearly unfair. Politicians need to hear a demand for reform from the people – in Alberta and beyond – in order for it to happen.

To DONATE to help us spread the word in Alberta of the importance of this referendum, and build a national coalition for meaningful reforms, thank you for using our donation form HERE – any amount helps!

Note: Donors to this site must agree to their name and donation being disclosed to Elections Alberta, since advertising during the referendum campaign period is subject to third-party advertising laws.